Why are tech IPOs such a big disappointment this year? The latest IPO, Zynga, is trading down from its Friday debut (currently around $9 versus its first IPO trade at $11). It’s not just Zynga or the overall market (which is also down). Just look at almost any tech IPO this year, many are below where they first traded on the day their shares went public, including LinkedIn (now trading at $65 vs. opening at $83 on its IPO), Groupon (now at $22 vs. $28), Pandora (now at $20 vs. $10).

Part of the reason for the lackluster post-IPO performance is that the entire stock market has gone nowhere this year. But there is something more going on here with tech IPOs in particular. They are suffering from the fact that, for a variety of reasons, they were all delayed IPOs. By that I mean that tech companies are pushing off going public as long as they can. They are raising huge pre-IPO rounds privately in what Sequoia Capital’s Michael Moritz calls “the public financing of twelve years ago.” Twitter raised $800 million just three months ago, which included the most-recently disclosed$300 million Saudi investment—that’s like doing an IPO without any of the hassles of being a public company.

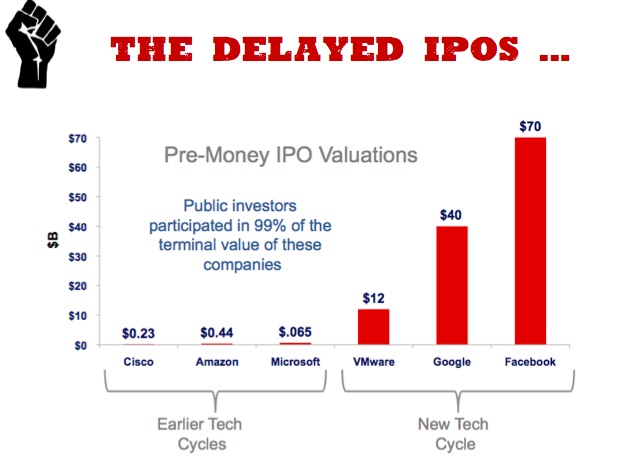

While delaying these IPOs may be good for the companies, it is not great for public investors because by the time they get their hands on any shares, most of the value will already be baked into their price. If you simply compare the pre-IPO valuations of the current crop of Internet companies to earlier tech darlings like Amazon or even Google, it’s clear that most of the value is being captured by the private investors, not the public ones.

Back in the day, public investors were able to capture 99 percent of the “terminal value” of companies like Amazon, Cisco, or Microsoft (see slide above from Bullpen Capital‘s Duncan Davidson, and avideo interview with him here). But now so much of the terminal value is captured before the IPO. Facebook is already worth $70 billion to $80 billion, and will be lucky to get a $100 billion valuation when it IPOs.

The flip side to sky-high pre-IPO valuations is that there will be less upside for post-IPO investors (i.e., the general public). And in some cases, even investors in some of these late mega-rounds won’t see a return at the IPO. Investors in Zynga’s last private round—including Kleiner Perkins, T. Rowe Price, Morgan Stanley, and Fidelity—paid $14 a share. They are all still under water (albeit Kleiner has shares from earlier rounds as well, which are worth a considerable amount).

Personally, I think most of these are good companies that may very well grow into their valuations and beyond. If they execute, there is no question some of these stocks could double or better over the next few years. I am not saying these are bad investments. But will any of the current crop of Internet IPOs (including Facebook when it comes out) produce a 10,000 percent return post-IPO like Amazon did? Those days are over.

Source:http://techcrunch.com/2011/12/19/tech-ipos-bleh/

Part of the reason for the lackluster post-IPO performance is that the entire stock market has gone nowhere this year. But there is something more going on here with tech IPOs in particular. They are suffering from the fact that, for a variety of reasons, they were all delayed IPOs. By that I mean that tech companies are pushing off going public as long as they can. They are raising huge pre-IPO rounds privately in what Sequoia Capital’s Michael Moritz calls “the public financing of twelve years ago.” Twitter raised $800 million just three months ago, which included the most-recently disclosed$300 million Saudi investment—that’s like doing an IPO without any of the hassles of being a public company.

While delaying these IPOs may be good for the companies, it is not great for public investors because by the time they get their hands on any shares, most of the value will already be baked into their price. If you simply compare the pre-IPO valuations of the current crop of Internet companies to earlier tech darlings like Amazon or even Google, it’s clear that most of the value is being captured by the private investors, not the public ones.

Back in the day, public investors were able to capture 99 percent of the “terminal value” of companies like Amazon, Cisco, or Microsoft (see slide above from Bullpen Capital‘s Duncan Davidson, and avideo interview with him here). But now so much of the terminal value is captured before the IPO. Facebook is already worth $70 billion to $80 billion, and will be lucky to get a $100 billion valuation when it IPOs.

The flip side to sky-high pre-IPO valuations is that there will be less upside for post-IPO investors (i.e., the general public). And in some cases, even investors in some of these late mega-rounds won’t see a return at the IPO. Investors in Zynga’s last private round—including Kleiner Perkins, T. Rowe Price, Morgan Stanley, and Fidelity—paid $14 a share. They are all still under water (albeit Kleiner has shares from earlier rounds as well, which are worth a considerable amount).

Personally, I think most of these are good companies that may very well grow into their valuations and beyond. If they execute, there is no question some of these stocks could double or better over the next few years. I am not saying these are bad investments. But will any of the current crop of Internet IPOs (including Facebook when it comes out) produce a 10,000 percent return post-IPO like Amazon did? Those days are over.

Source:http://techcrunch.com/2011/12/19/tech-ipos-bleh/

No comments:

Post a Comment