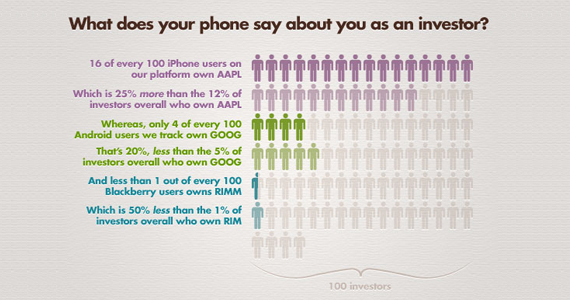

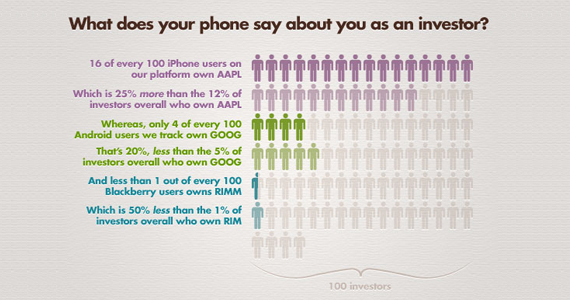

A study by investment analysis startup SigFig suggests that iPhone-owning investors are 20% more likely than the average investor to also own Apple stock, while investors with Androids are 25% less likely to own Google than average. This is just one startup’s limited data, so don’t get all excited and assume that this is the case worldwide. But still, it makes for an entertaining look at just how loyal those Apple fans are.

SigFig gets the data from its Wikinvest site, which tracks $20 billion in investments. More than $5 billion of the total goes their mobile phones – not much by public market standards, but still something to look at. The company then correlates users’ investment portfolios to their mobile phone operating systems to see who is using and buying what.

From the company blog post today by SigFig data team member Andrei Kopelevich:

SigFig (Significant Figures) is a registered investment advisor with the SEC, and is planning to launch a new toll that will include enhancements to the exiting product but will also “analyze your holdings and transactions to recommendations so you can improve your portfolio,” spokesperson Samantha Murillo tells me. “For example, if you’re investing in an underperforming fund, or if you’re getting ripped off through fees, we’ll let you know.”

Source:http://techcrunch.com/2011/12/15/sigfigapplegoogle/

SigFig gets the data from its Wikinvest site, which tracks $20 billion in investments. More than $5 billion of the total goes their mobile phones – not much by public market standards, but still something to look at. The company then correlates users’ investment portfolios to their mobile phone operating systems to see who is using and buying what.

From the company blog post today by SigFig data team member Andrei Kopelevich:

- Apple mobile users are indeed fanboys through and through. More than 16% of iPhone and iPad users own Apple stock, making them 20% more likely to own Apple than our average user (12.8% of our population owns Apple). Their Apple stock ownership also outpaces Android users two to one (8.2% own Apple) and BlackBerry users (6.5%).

- Loyalty doesn’t swing both ways. For Android, we checked both device and software manufacturers and found only 4.0% of Android users own Google and less than 1% own Motorola. Those numbers are lower across the board than our general population (5.0% and 0.8%, respectively), meaning not only do Android users not show loyalty, they actually invest in Google 25% less frequently than the general population.

- This trend continues for BlackBerry users, who are 50% less likely to invest in RIM

He goes on to wonder why there’s such a big disparity in Apple ownership, especially when Google’s stock is doing so well in the past few months, and Apple’s is (oddly) not. It’s also worth pointing out that Android users are less invested in any of the tech stocks above versus the average investor, so their lower investment in Google doesn’t necessarily mean they’re less keen on Google per se. Maybe they’re in oil?

Wikinvest, launched in June of 2010, tracks stock performance data from more than 65 brokerages within a single dashboard, analogous to consumer finance site Mint, and also contains news, graphs and other features. It’s continuing to live on, but SigFig is busy working on a new as yet unlaunched product.SigFig (Significant Figures) is a registered investment advisor with the SEC, and is planning to launch a new toll that will include enhancements to the exiting product but will also “analyze your holdings and transactions to recommendations so you can improve your portfolio,” spokesperson Samantha Murillo tells me. “For example, if you’re investing in an underperforming fund, or if you’re getting ripped off through fees, we’ll let you know.”

Source:http://techcrunch.com/2011/12/15/sigfigapplegoogle/

No comments:

Post a Comment