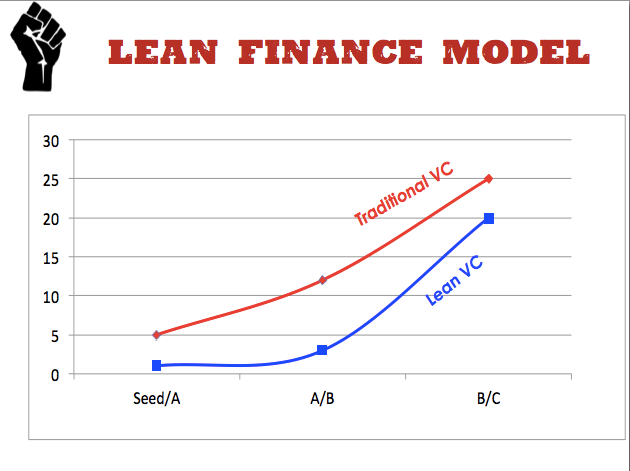

Tech startups don’t need $5 million A rounds when $2 million to $3 million will do. So A rounds now get bypassed until a company proves itself and then you see these huge later-stage rounds. Or sometimes the startup gets sold for $30 million to $50 million, which is okay, since it didn’t have to grow into a huge valuation to begin with.

In this view, we are not really seeing a Series A Crunch (where the growing number of seed-funded companies are failing to find series A money). Rather, they are getting smaller amounts to see them through until acquisition or a later mega-round where the big VCs throw their weight around. “I call it a shovel-in round,” he says. “We go under the A.”

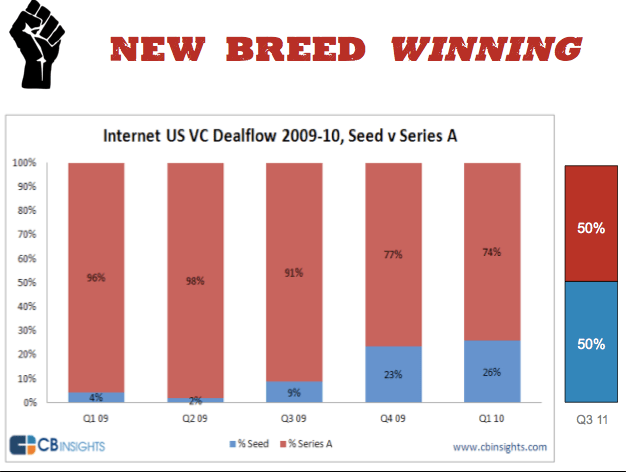

He notes that now half of all of the first institutional money going into startups is now “coming from a new breed of super angels.” This is a dramatic change from just two years ago,when less than 10 percent of the money was coming from super angels (see slide below).

The big-name VCs will still do okay. In the first half of this year, 7 top-tier firms commanded 80 percent of all the money going to venture capital. It’s the middle tier firms that are scrambling for survival.

No comments:

Post a Comment